Artificial Intelligence - a bubble?

- Dobromir Risov

- Nov 21, 2025

- 5 min read

Updated: Nov 25, 2025

By Dobromir Risov November 2025

Intro

When I browsed the other day a news site I read about one Central Bank warning regards investments in Artificial Intelligence. Probably a couple of weeks ago I read about Jeff Bezos, (founder of Amazon) stating: every project regards Artificial Intelligence is being financed no matter what. With other words investors do not question the financial viability and "blindly" finance Artificial Intelligence. I write about the financial viability in general in Personal Investing. Today I write about the history of Artificial Intelligence. AI has been around for quite some time, it is nothing new. Then I analyse one stock. I apply two ratios to assess the stock for investment and look at a three year chart.

Main

History

The origins of Artificial Intelligence go back as far as the antique time according to Wikipedia. The antique started around 8th century BC. From today´s perspective this is some 3000 years ago. Back then people were talking about the

“consciousness and intelligence of master craftsmen”.

A key feature of artificial intelligence is that thinking can be mechanised. Like a machine. Philosophers in the 13th and 14th century played an important role in developing formal reasoning to promote the idea. The Spanish Raymond Llull and 400 years later, the German Gottfried Leibniz are mentioned as philosophers with a significant influence in this area.

Fast forward from 17th century to the 20th century: a workshop at the University of Dartmouth in 1956 is stated to be a key point in developing Artificial Intelligence. US government was persuaded to use public funds for further research and development. Public funding went on for about 20 years before it was stopped due to poor results. The UK and Japan were also players in Artificial Intelligence.

The interest in AI didn´t cease and private financing was tapped into to continue research and development in this field. Fast forward to the 2020s: the AI-sector focuses on large language models (LLM) like Chat GPT or Gemini.

Analysis

I move now from a technical & historical to a business & financial perspective: When I buy a stock I expect a return. I buy a very very tiny portion of a business. So the return comes in form of business earnings. It shows itself with dividends or capital appreciation. The higher the earnings and lower the price of the stock the better for me. I calculate the Earnings per Share (EPS) and the Earnings Yield. And I show a stock chart to look at capital appreciation.

Nvidia

I read in Google search the company says it is “world leader in artificial intelligence computing”.

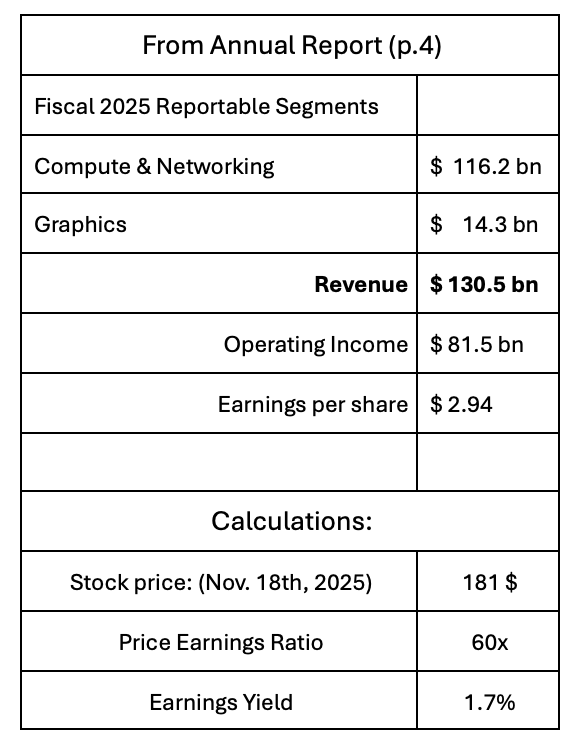

The company was founded in 1993, it is a young company. It is based in California according to Wikipedia. When I open the Annual Report 2025 I see Nvidia reports in two segments: compute/networking and graphics. The first segment accounts for the vast majority of revenue: 89%.

I calculated the two ratios to assess a potential investment. First, the Price Earnings Ratio using the up to date stock price and the most recent earnings. Secondly, I calculated the Earnings Yield. The EY is the inverse of the PE ratio. Conclusion: When I look at the PE ratio, it tells me, an investment in Nvidia breaks even in 60 years. If the stock was to drop, while the earnings remain stable, the PE ratio would improve. So an investment would take less than 60 years to break even. When I assess the Earnings Yield, I arrive at an annual return of 1.7%. Now I can compare that with another stock´s yield. When the stock price of Nvidia goes down, the EY goes up, provided the earnings don´t change. That is beneficial.

Stock performance of Nvidia and two major indices

What probably some readers ask themselves, is whether Nvidia stock will perform during the next three years like it has performed during the last three years?

Nvidia stock has been outperforming two major US indices, the S&P 500 and the Nasdaq. Both indices have done well during the last three years. Take a look at the y-axis of the chart: the smallest unit is 200%! Yes! Let that sink in. Both indices are somewhere in the middle. I´d say they have gone up by around 80%-100%. Now, Nvidia: its stock price went up by around 1100% during the same period. It is not surprising at current levels it takes 60 years to break even. Back to the question: are the next three years going to be as rewarding for Nvidia investors as the last three years were? I don´t know. It´s possible but is it probable? The stock price can stay more or less unchanged or drop significantly. If you are considering following some stock forecast on Nvidia I suggest to read Forecasting Markets & Stocks.

Summary

The idea about Artificial Intelligence is nothing new. In fact it is very old, some 3000 years. Various ancient cultures worked on the idea. This work has been carried on by philosophers in the 13th to 18th century. The increase in computational resources in the late 20th century gave more possibilities to accomplish the ancient idea. At first, it was governments who did the funding before ceasing it due to poor results. The promise didn´t change, but now it was private money who stepped in to fill the void. The hype that we know of – Large Language Models (Chat GPT) is a short phenomenon, since 2020s.

I analysed Nvidia, a company whose business is heavily dependent on the AI sector. Nvidia is profitable. It´s stock is trading very high as the chart shows. The stock has outperformed 2 major indices. The conclusion being at current levels it would take an investment in Nvidia 60 years to break even. This is a very long period and as such not attractive to an investor.

I advise the personal investor to stay away from analysing and buying single stocks. It takes a lot of time and finding the next Nvidia is more than challenging. Time being a limited resource is probably better spent in the park. I focus in the personal investment course on investing in asset classes: Courses (List)

Sources:

Artificial Intelligence History: https://en.wikipedia.org/wiki/History_of_artificial_intelligence

Classical antiquity: https://en.wikipedia.org/wiki/Classical_antiquity

Nvidia figures https://s201.q4cdn.com/141608511/files/doc_financials/2025/annual/NVIDIA-2025-Annual-Report.pdf

Chart:

Frequently Asked Questions (FAQs):

Is Artificial Intelligence a bubble? This term has been used in the news recently. Those articles have referred to investments in this sector. Governments have spent huge sums of money to do research & development in the 20th century. With little results, hence government funding was stopped. Other ways were found to continue work in this field via private funding. A case by case analysis is needed to arrive at a conclusion if it´s a bubble on a company level.

Is Nvidia a good investment? Nvidia is a young tech company from the United States. From a business perspective, Nvidia is heavily exposed to the Artificial Intelligence sector. From a financial perspective, the company is profitable, reporting earnings of $3 per share. You can buy currently the share for $180. So, an investment in Nvidia would take 60 years to break even, that is a long period. Alternatively, that equals an earnings yield of 1.7%.

What is the idea behind Artificial Intelligence? At the start it was about "consciousness and intelligence of master craftsmen”. Later it was about developing a machine to do the thinking. Today, the public knows about Artificial Intelligence through large language models (LLMs), for example Chat GPT or Gemini.

Comments